A project finance model is written in order to assess the feasibility and bankability of a particular project (for our purposes, an infrastructure project of some kind).

Project finance models are also referred to as project models, base case models, lenders’ models or lenders’ base case models.

These models are also used to set prices or tariffs.

As such, a project finance model has specific characteristics which differentiate it from other business case models. In particular, it is much more concerned with cash flows than income statement of balance sheet.

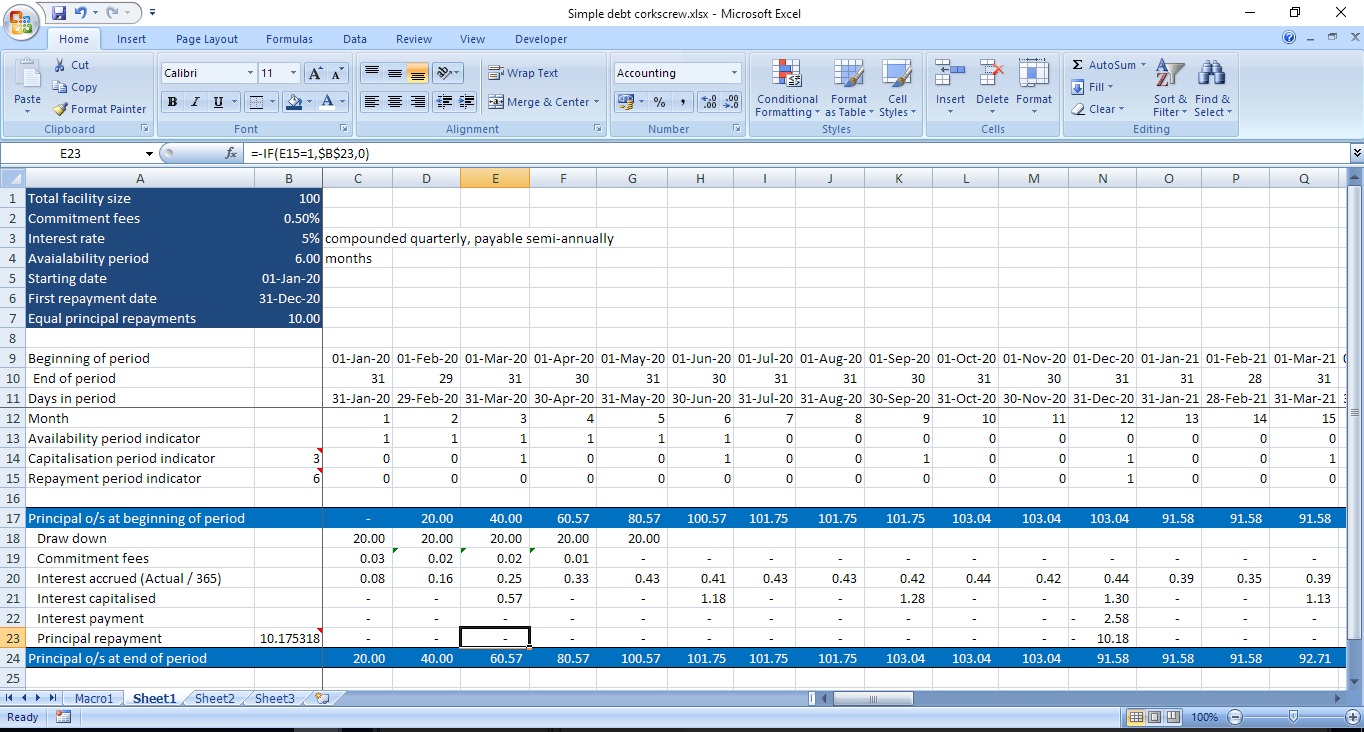

If it is a lenders’ model, it will (obviously) contain one or more debt sections, cash flow waterfalls, covenant ratio calculations, and the ability to stress input assumptions in order to determine the effect of adverse circumstances upon the project.

Please note that the articles which follow are not necessarily project finance model gospel. Rather, they indicate my personal preferences relating to the way in which a project model should be laid out and written.